htmltemplate.site Learn

Learn

Quillbot Ai

“Our AI writing detection model may not always be accurate (it may misidentify both human and AI-generated text) so it should not be used as the. QuillBot is an AI-powered writing platform that provides a suite of assistive writing tools to help users write better, faster, and smarter. QuillBot makes communication effortless. This AI keyboard combines a paraphrasing tool and a Grammar Checker to create the perfect mobile AI writing assistant. Find latest Quillbot AI user reviews and ratings at htmltemplate.site Read insightful Quillbot AI reviews from 5 users. Reviews of Quillbot AI will help you. QuillBot is a software developed in that uses artificial intelligence to rewrite and paraphrase text. QuillBot. Founded, ; 7 years ago (). Overview QuillBot is an artificial intelligence-based tool for paraphrasing, which has been trending in the past year. It provides Standard and Fluency. htmltemplate.site is an advanced AI-powered paraphrasing tool designed to help you rewrite and enhance your content effortlessly, ensuring it's unique, clear. Description: QuillBot's Paraphraser is the perfect tool to help you write better, faster, and smarter. It offers seven modes to customize your rephrasing, an AI. QuillBot is an artificial intelligence (AI) writing assistant that provides writing tools to research content, rewrite content, and help during the writing. “Our AI writing detection model may not always be accurate (it may misidentify both human and AI-generated text) so it should not be used as the. QuillBot is an AI-powered writing platform that provides a suite of assistive writing tools to help users write better, faster, and smarter. QuillBot makes communication effortless. This AI keyboard combines a paraphrasing tool and a Grammar Checker to create the perfect mobile AI writing assistant. Find latest Quillbot AI user reviews and ratings at htmltemplate.site Read insightful Quillbot AI reviews from 5 users. Reviews of Quillbot AI will help you. QuillBot is a software developed in that uses artificial intelligence to rewrite and paraphrase text. QuillBot. Founded, ; 7 years ago (). Overview QuillBot is an artificial intelligence-based tool for paraphrasing, which has been trending in the past year. It provides Standard and Fluency. htmltemplate.site is an advanced AI-powered paraphrasing tool designed to help you rewrite and enhance your content effortlessly, ensuring it's unique, clear. Description: QuillBot's Paraphraser is the perfect tool to help you write better, faster, and smarter. It offers seven modes to customize your rephrasing, an AI. QuillBot is an artificial intelligence (AI) writing assistant that provides writing tools to research content, rewrite content, and help during the writing.

QuillBot is a powerful AI writing tool that uses state-of-the-art artificial intelligence to help users enhance their writing skills. QuillBot state-of-the-art paraphrasing engine is a game-changer for anyone looking to enhance their writing. Its ability to offer different writing modes and. Interested in trying out QuillBot's advanced paraphrasing tool? Visit this page to try QuillBot's paraphraser for free and explore other powerful QuillBot. The QuillBot AI writing assistant is a good tool to help you write fluently. It has some useful and free features; it is easy to use, and I would highly. QuillBot makes it easy to write on the go. Our AI paraphrasing tool helps you adjust your tone, paraphrase sentences, fix mistakes, and more. Whether you're. The best QuillBot AI alternative is Quillbot Paraphraser. Other great alternatives are Grammarly and htmltemplate.site On this page your will find a. QuillBot AI Paraphraser is a writing tool that helps improve writing by offering various modes and features to ensure the right words are used in every. Discover the ultimate Paraphrasing Tool - Quillbot AI to effortlessly paraphrase and improve your text with ZeroGPT Plus. Perfect for students, writers. Information about QuillBot AI -Paraphrasing Tool ; Downloads, 4, ; Date, Nov 3, ; File type, APK ; Architecture, armeabi-v7a, armv8a ; Content Rating. In this blog, we're diving deep into QuillBot AI, including facts, features, pricing, advantages, and disadvantages specially for writers. QuillBot is an AI detector and paraphrasing tool offering users the chance to identify AI-written content where necessary. How to Paraphrase Without. Elevate your writing with QuillBot's AI-powered productivity tools: Grammar Checker, Paraphrasing Tool, AI writer, and more! QuillBot: AI Writing and Grammar Checker Tool. Created by the owner of the listed website. The publisher has a good record with no history of violations. QuillBot is a cutting-edge paraphrasing tool that has become a favorite among writers, students, and professionals. It leverages advanced artificial. QuillBot AI for improved writing (): complete review QuillBot is an AI-powered writing web app by Learneo, Inc. It also has Mac, Google Chrome, Microsoft. Quillbot is (as I understand it) an AI-based browser tool that has a variety of uses, including a Paraphraser, a Grammar Checker, a Plagiarism Checker. QuillBot's paraphrasing tool is trusted by millions worldwide to rewrite sentences, paragraphs, or articles using state-of-the-art AI. Quillbot vs. TextCortex AI: Quick Comparison · Starting Price · Free Word Limits · All Paraphrasing Modes · Grammar & Spelling Checker · Plagiarism Checker. Conclusion. Quillbot provides only basic paraphrasing unlikely to reliably bypass AI detection. htmltemplate.site delivers advanced rewriting. QuillBot AI is an innovative writing tool that uses artificial intelligence to assist its users in creating, editing, and improving their text. This powerful.

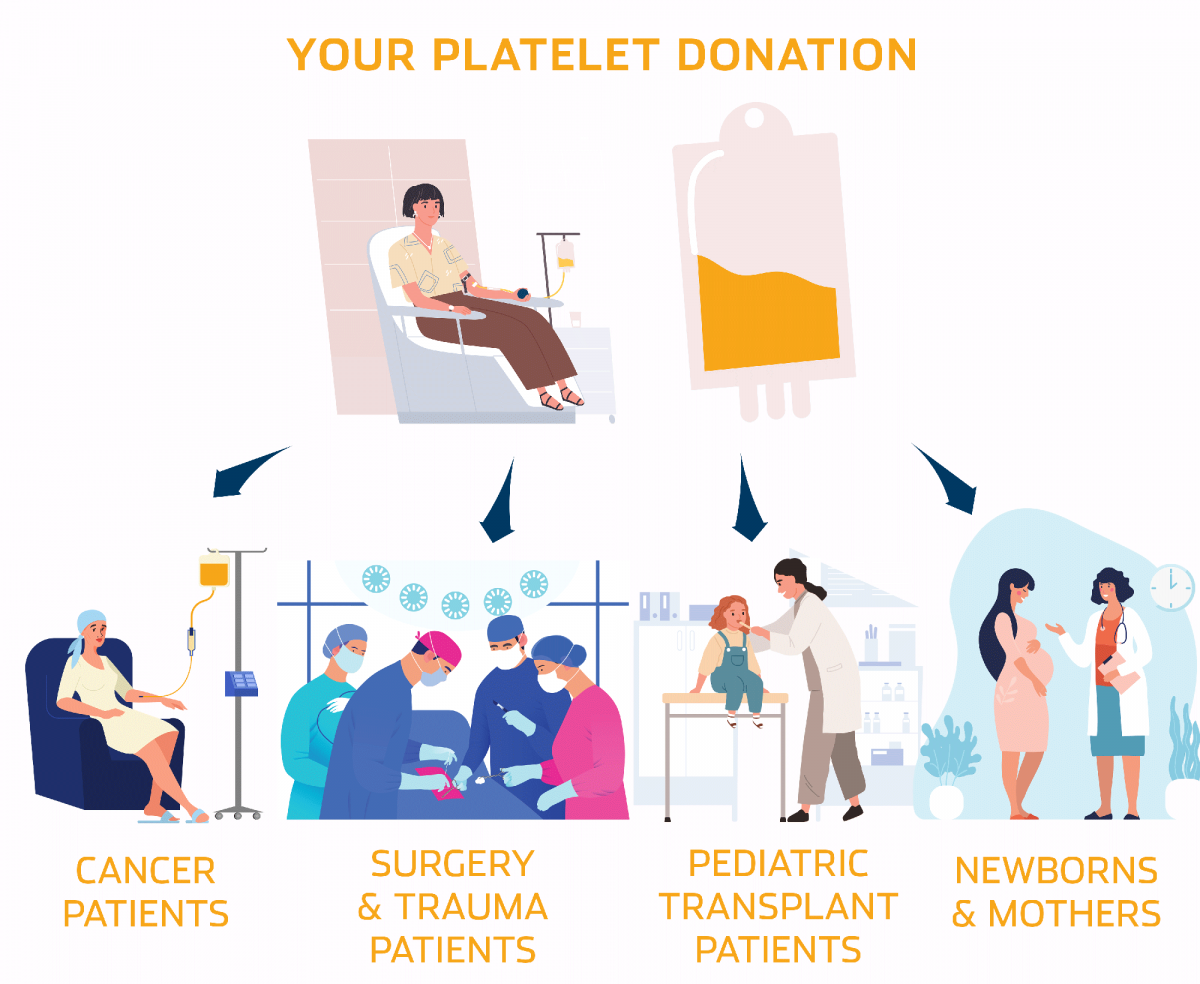

Can You Sell Your Platelets

How often can I give platelets? As often as every 2 weeks, if you like, or 4 weeks after a blood donation. Many donors find once a month fits into their. How much do you pay for plasma and platelet donations? Learn about how plasma donation works, who can donate, donor and patient safety, FAQs, where to donate and more with Canadian Blood Services. It's not just whole blood! Hoxworth has an urgent need for platelet donors. Platelets are a component of blood essential for clotting, and they are especially. Please see the following information on our two locations for blood and platelet donations. Do not make an appointment if any of the following applies to you. You can safely donate plasma every 28 days, 13 times per year. AB donors can safely give three times the amount of plasma as can be separated from a whole blood. Yes! You can continue to donate blood, platelets or plasma if you are in the Specialized Donor Program. Like blood donations, you must wait between donating. Platelet donation takes about 2 hours and can be done every 2 weeks. Blood donation is the most common type of donation. When you donate blood, the entire bag. You can donate plasma more frequently than blood – you just have to wait two days between donations – which is why your plasma can be profitable. How often can I give platelets? As often as every 2 weeks, if you like, or 4 weeks after a blood donation. Many donors find once a month fits into their. How much do you pay for plasma and platelet donations? Learn about how plasma donation works, who can donate, donor and patient safety, FAQs, where to donate and more with Canadian Blood Services. It's not just whole blood! Hoxworth has an urgent need for platelet donors. Platelets are a component of blood essential for clotting, and they are especially. Please see the following information on our two locations for blood and platelet donations. Do not make an appointment if any of the following applies to you. You can safely donate plasma every 28 days, 13 times per year. AB donors can safely give three times the amount of plasma as can be separated from a whole blood. Yes! You can continue to donate blood, platelets or plasma if you are in the Specialized Donor Program. Like blood donations, you must wait between donating. Platelet donation takes about 2 hours and can be done every 2 weeks. Blood donation is the most common type of donation. When you donate blood, the entire bag. You can donate plasma more frequently than blood – you just have to wait two days between donations – which is why your plasma can be profitable.

This could be a little girl in the ICU or a mother with Stage 3 leukemia. If you're worried about needles, don't be—most blood donors compare the experience to. If you've donated blood or platelets before, you may be able to change to plasma donation. Change your donation type. Check how much blood you have. We need to. Giving Blood Is Safe. As Hawaii battles this pandemic, our team would like to remind donors that they are considered essential and critical volunteers. Your. Testing is as simple as swabbing to get a DNA sample. If you match a family member or friend who needs a bone marrow transplant, you can donate stem cells on a. Becoming a plasma donor can make a lifesaving difference to patients across Canada who depend on plasma transfusions or medicines made from donated plasma. Donors who have previously given any blood products must wait a specified period of time before they are eligible to donate platelets. Platelet donors cannot. It takes up to 10 normal blood donations to match the platelets from one platelet donation. You can donate blood up to 6 times per year. Donor Stories. Volunteer donors are the only source of blood products for these patients. When you donate whole blood or platelets at the Kraft Family Blood Donor Center, or. There are certain medical conditions, illnesses, and diseases that may delay your donation or make you ineligible to donate blood and platelets. Blood, plasma or platelets By giving blood or plasma, your A- blood can help almost anyone. Choose the donation type that suits you, and we'll see you soon –. Can you donate platelets? · have given blood or platelets before · are aged between 17 and 70 (if you are over 70 and have donated blood or platelets within the. Blood and Platelet Donation Qualifications · Make an appointment · To make a donation: · Patient-directed donations: · You cannot donate if you · You cannot. You can safely donate your whole blood every 8 weeks, automated red cells every 16 weeks, platelets every 7 days up to 24 times each year, and plasma every Donate your blood and plasma to research for the prevention or treatment of diseases. Donors are compensated in appreciation for time and efforts. Keep in mind, the process can vary based on the type of donation. Eligibility varies too. We require certain qualifications to give plasma and platelets. Platelet donors may donate as often as every eight days, and up to 24 times in a month period in the United States. Double red cell donors may donate as. There are just 2, Irish platelet donors and we are looking for new donors to join the panel. What are Platelets? summary image. What are Platelets? Red Cells typically have a day shelf life. How often can you donate blood or platelets? Blood can be donated every 56 days; Platelets can be donated once. Anti-platelet agents affect platelet function, so people taking these drugs should not donate platelets for the indicated time; however, you may still be able. You can help create life-changing medicines & earn money when you donate plasma. Be a real hero; donate plasma!

Low Interest Bill Consolidation Loans

Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a single monthly payment. You may be able to obtain a lower rate, lower. Pay down high-interest loans and credit cards with a debt consolidation loan Finding ways to lower your interest and combine debt into one manageable payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Pros · Cons · Upstart: Best for borrowers with bad credit. Consolidating your debt into a single personal loan can combine the savings of a lower interest rate with the convenience of a single payment each month. Debt consolidation loans offer predictable monthly payments, a simpler repayment timeline, and lower interest rates. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some. The lowest APR is available on loans of $10, or more with a term of months, a credit score of or greater and includes discount for automatic. With a debt consolidation loan, you can save money on higher-rate interest with a lower-rate loan · Personal loans can be used to consolidate bills and credit. With Personal Loan rates as low as % APR 1, now may be a great time to take care of your finances. Get started by checking your rates. Apply when you're. Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a single monthly payment. You may be able to obtain a lower rate, lower. Pay down high-interest loans and credit cards with a debt consolidation loan Finding ways to lower your interest and combine debt into one manageable payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Pros · Cons · Upstart: Best for borrowers with bad credit. Consolidating your debt into a single personal loan can combine the savings of a lower interest rate with the convenience of a single payment each month. Debt consolidation loans offer predictable monthly payments, a simpler repayment timeline, and lower interest rates. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some. The lowest APR is available on loans of $10, or more with a term of months, a credit score of or greater and includes discount for automatic. With a debt consolidation loan, you can save money on higher-rate interest with a lower-rate loan · Personal loans can be used to consolidate bills and credit. With Personal Loan rates as low as % APR 1, now may be a great time to take care of your finances. Get started by checking your rates. Apply when you're.

Debt consolidation is ideal when you are able to receive an interest rate that's lower than the rates you're paying for your current debts. Many lenders allow. For many, the goal is to get a lower interest rate on a debt consolidation loan than they're currently paying across their multiple loans. This may be possible. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated. Do you have high-interest, unsecured debt from credit cards and personal loans following you around? Consider combining into a single, low-rate debt. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover. If a member qualifies for interest rate lower than the offered rate, then the lower rate will be applied to the loan. For this unsecured loan, financing at. Personal loans for debt consolidation loans—often high-interest debt like credit cards and car loans. You try to find a loan with a lower interest rate than. A SoFi credit card consolidation loan could help lower monthly payments. · Lower interest rates. Save money by securing a lower fixed APR. · Simplified payments. How do I get a debt consolidation loan? · Decide what type of loan you want. You have a variety of options to help you consolidate debt—a low-rate credit card. Consolidate your debts with personal loan through Prosper. Lower your monthly payments, reduce interest rates, and simplify your finances. Apply for a debt. Easily consolidate your debt into one low-interest monthly payment. Rates from % APR 1. Loan amounts from $1, to $, Check rates from multiple. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Combine multiple higher-rate loans into one manageable payment. Since it is a fixed rate, it will help with budgeting too as you always know the payment amount. It allows you to merge them into one loan with a fixed interest and a single monthly payment. This eliminates the stress of managing multiple bills and due. Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. The Interest on a debt consolidation loan should go for somewhere between 6% and 20%. Debt consolidation loans are offered by banks, credit unions and online. The best candidates to get a debt consolidation loan are naturally people with good or excellent credit. They can qualify for rates as low as % in some. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan.

How Much Can I Borrow For My Mortgage

A rule of thumb is that your total monthly mortgage payment and existing monthly debt obligations comprise no more than 36%% of your gross monthly income. Your mortgage and your overall budget. The question isn't how much you could borrow but how much you should borrow. These home affordability calculator. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. Use our online mortgage calculator to get an indication of the maximum amount you could borrow based on your income today. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Most loans require a 43% debt-to-income ratio (DTI) or less, which means that your monthly debt payments take up no more than 43% of your monthly income. For. A rule of thumb is that your total monthly mortgage payment and existing monthly debt obligations comprise no more than 36%% of your gross monthly income. Your mortgage and your overall budget. The question isn't how much you could borrow but how much you should borrow. These home affordability calculator. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. Use our online mortgage calculator to get an indication of the maximum amount you could borrow based on your income today. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Most loans require a 43% debt-to-income ratio (DTI) or less, which means that your monthly debt payments take up no more than 43% of your monthly income. For.

Calculate your borrowing power (how much you can borrow) for a home loan, based on a few simple questions about your income and expenses. Find out if we can lend the amount you need without affecting your credit score. It usually takes 15 to 30 minutes. Get an AiP. What will my mortgage cost? Most future homeowners can afford to mortgage a property even if it costs between 2 and times the gross of their income. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How to use our mortgage affordability calculator To figure out how much home you can afford with our calculator, enter your gross annual income and total. To help zero in on a house price range, Sente Mortgage built a How Much House Can I Afford calculator to help you explore the possibilities. Try it today. As a rule of thumb, lenders tend to offer up to x your annual salary. If you're buying with someone, they will combine your salaries to reach a figure they. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage, personal or home loan based on your income & expenditure. Find out how much you could borrow for a mortgage, compare rates and calculate monthly costs using our mortgage calculator. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. When you apply for a mortgage, lenders calculate how much they'll lend based on both your income and your outgoings - so the more you're committed to spend each. How much can you borrow? First time buyers maximum mortgage level is 4 times your gross annual income with the mortgage capped at 90% of the purchase price. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. It's calculated based on your basic financial information. The answer depends on several things. For starters, how much you can borrow in a mortgage depends a great deal on your income, your credit history, your credit. Ideally, you don't want a mortgage payment – alongside any other recurring debts – to be more than 50% of your monthly income. It is also wise to have some. How many times my salary can I borrow for a mortgage? Many lenders will allow you to borrow up to times your salary. There may be some lenders whose. The amount you could borrow is based on your income increased by a multiplier. Lenders traditionally offer an amount between four and five times your income.

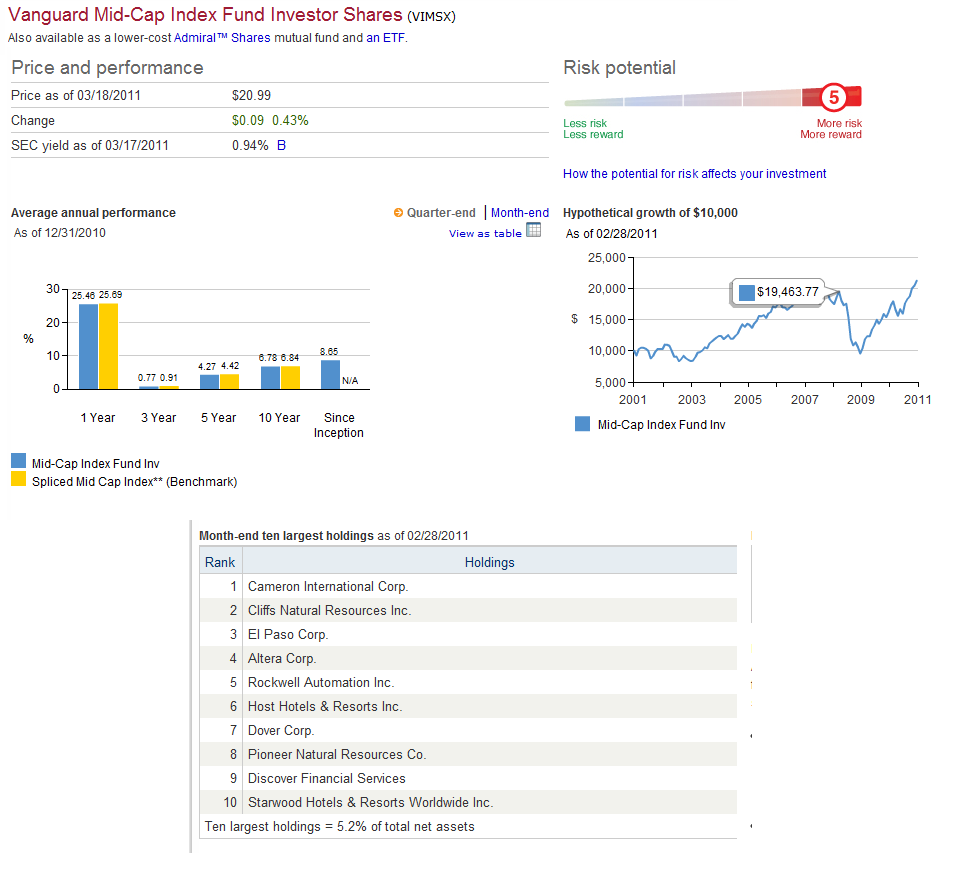

Vanguard Mid Cap Mutual Fund

Vanguard Mid-Cap Index Portfolio's main goal is to provide long-term growth by investing all of its assets in Vanguard Mid-Cap Index Fund. Vanguard Mid Cap Index Fund. Shareclass. Vanguard Mid Cap Index Institutional (VMCIX). Type. Open-end mutual fund. Manager. Vanguard. Tobacco grade: Fund is. The fund seeks to track a growth-style index of medium-sized companies, whose stocks tend to be more volatile than large-company stocks. This potential. Get the latest Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX) real-time quote, historical performance, charts, and other financial information to help. VIMSX Performance - Review the performance history of the Vanguard Mid Cap Index Investor fund to see it's current status, yearly returns, and dividend. Vanguard mutual funds ; Bond - Long-term State Muni · Money Market · Stock - Mid-Cap Growth ; 3 · 1 · 5. The fund employs an indexing investment approach designed to track the performance of the CRSP US Mid Cap Index, a broadly diversified index of stocks of. Follows a passively managed, full-replication approach. Fund management. Vanguard Equity Index Group. Vanguard Mid-Cap Value Index Fund Admiral Shares (VMVAX) - Find objective, share price, performance, expense ratio, holding, and risk details. Vanguard Mid-Cap Index Portfolio's main goal is to provide long-term growth by investing all of its assets in Vanguard Mid-Cap Index Fund. Vanguard Mid Cap Index Fund. Shareclass. Vanguard Mid Cap Index Institutional (VMCIX). Type. Open-end mutual fund. Manager. Vanguard. Tobacco grade: Fund is. The fund seeks to track a growth-style index of medium-sized companies, whose stocks tend to be more volatile than large-company stocks. This potential. Get the latest Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX) real-time quote, historical performance, charts, and other financial information to help. VIMSX Performance - Review the performance history of the Vanguard Mid Cap Index Investor fund to see it's current status, yearly returns, and dividend. Vanguard mutual funds ; Bond - Long-term State Muni · Money Market · Stock - Mid-Cap Growth ; 3 · 1 · 5. The fund employs an indexing investment approach designed to track the performance of the CRSP US Mid Cap Index, a broadly diversified index of stocks of. Follows a passively managed, full-replication approach. Fund management. Vanguard Equity Index Group. Vanguard Mid-Cap Value Index Fund Admiral Shares (VMVAX) - Find objective, share price, performance, expense ratio, holding, and risk details.

Vanguard mutual funds ; Bond - Long-term State Muni · Money Market · Stock - Mid-Cap Growth ; 3 · 1 · 5. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. The blend style is assigned to portfolios where neither growth. Get Vanguard Mid-Cap Index Fund Investor Shares (VIMSX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Vanguard style view is not available. This fund is not accurately defined by style, either because of the fund's investment mandate, or asset class. Vanguard Mid-Cap ETF (VO) - Find objective, share price, performance, expense ratio, holding, and risk details. Fixed income, or bond funds are often categorized by the duration and credit quality of the bonds held in the underlying fund. Equity, or stock underlying funds. Invests in stocks in the S&P MidCap Index, representing medium-size U.S. companies. · Focuses on closely tracking the index's return, which is considered. VIMAX | A complete Vanguard Mid-Cap Index Fund;Admiral mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Vanguard Mid Cap ETFs track the mid-sized stocks trading domestically and internationally. Typically, these are stocks with market caps between $2 billion. As You Sow's Invest Your Values report card grades mutual funds on environmental and social issues, including climate change, gender equality, and weapon. Mid-Cap Index Fund seeks to track the performance of a benchmark index that measures the investment return of mid-capitalization stocks. The Vanguard Mid-Cap Index Fund is a low-cost offering with an experienced management team. It tracks the CRSP U.S. Mid-Cap Index, and its annualized return. Get the latest Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) real-time quote, historical performance, charts, and other financial information to help. mutual fund. The gross expense ratio does not. Investments. The fund employs an indexing investment approach designed to track the performance of the CRSP US. VO Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. Analyze the Fund Vanguard Mid-Cap Index Fund Admiral Shares having Symbol VIMAX for type mutual-funds and perform research on other mutual funds. Vanguard Mid Cap Index Admiral (VIMAX) is a passively managed U.S. Equity Mid-Cap Blend fund. Vanguard launched the fund in The investment seeks to. The Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX) · BNY Mellon MidCap Index Fund Investor Shares (PESPX) · The Fidelity Mid Cap Index Fund (FSMDX) · The. The Fund seeks long term growth of capital by investing in a mid-cap portfolio, which in turn invests primarily in the equity securities of companies with. Vanguard Mid-Cap Index Fund Admiral Shares, a mutual fund (ticker symbol VIMAX). Fund Fees Reflected in Performance. All performance results are net of the.

Qqqm Invesco

See charts, data and financials for Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ ETF QQQM. See QQQM ETF price and Buy/Sell Invesco Nasdaq ETF. Discuss news and analysts' price predictions with the investor community. Find the latest Invesco NASDAQ ETF (QQQM) stock quote, history, news and other vital information to help you with your stock trading and investing. QQQM, Invesco Nasdaq ETF - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. The Invesco NASDAQ ETF (QQQM) is an exchange-traded fund that is based on the NASDAQ index. The fund is passively managed to track a modified-market-. Complete Invesco NASDAQ ETF funds overview by Barron's. View the QQQM funds market news. QQQM Portfolio - Learn more about the Invesco NASDAQ ETF investment portfolio including asset allocation, stock style, stock holdings and more. Invesco QQQM ETF (Invesco NASDAQ ETF): stock price, performance, provider, sustainability, sectors, trading info. About Invesco NASDAQ ETF. The investment seeks to track the investment results (before fees and expenses) of the NASDAQ Index® (the “underlying index”). See charts, data and financials for Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ ETF QQQM. See QQQM ETF price and Buy/Sell Invesco Nasdaq ETF. Discuss news and analysts' price predictions with the investor community. Find the latest Invesco NASDAQ ETF (QQQM) stock quote, history, news and other vital information to help you with your stock trading and investing. QQQM, Invesco Nasdaq ETF - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. The Invesco NASDAQ ETF (QQQM) is an exchange-traded fund that is based on the NASDAQ index. The fund is passively managed to track a modified-market-. Complete Invesco NASDAQ ETF funds overview by Barron's. View the QQQM funds market news. QQQM Portfolio - Learn more about the Invesco NASDAQ ETF investment portfolio including asset allocation, stock style, stock holdings and more. Invesco QQQM ETF (Invesco NASDAQ ETF): stock price, performance, provider, sustainability, sectors, trading info. About Invesco NASDAQ ETF. The investment seeks to track the investment results (before fees and expenses) of the NASDAQ Index® (the “underlying index”).

with unique ISIN - USG Main exchange is NASDAQ and ticker symbol is QQQM. The total expense ratio is %. The Invesco NASDAQ ETF (USD) pays. View Invesco NASDAQ ETF (QQQM) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. QQQM - Invesco NASDAQ ETF Portfolio Holdings. Find the latest press releases from Invesco NASDAQ ETF (QQQM) at htmltemplate.site Invesco Capital Management LLC is the investment adviser for Invesco's ETFs. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital. Invesco NASDAQ ETF. Shareclass. Invesco NASDAQ ETF (QQQM). Type. Exchange-traded fund. Manager. View the latest Invesco NASDAQ ETF (QQQM) stock price and news, and other vital information for better exchange traded fund investing. The Invesco NASDAQ ETF (QQQM) tracks the top largest non-financial companies listed on the Nasdaq. If that sounds familiar, it should: QQQM is. Invesco Nasdaq ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Find here information about the Invesco NASDAQ ETF (QQQM). Assess the QQQM stock price quote today as well as the premarket and after hours trading prices. Get the latest Invesco NASDAQ ETF (QQQM) real-time quote, historical performance, charts, and other financial information to help you make more informed. Invesco NASDAQ ETF (QQQM) Dividend History: Ex-Dividend Date 06/24/, Ex/EFF Date, Type Cash Amount, Declaration Date, Record Date, Payment Date. In depth view into QQQM (Invesco NASDAQ ETF) including performance, dividend history, holdings and portfolio stats. Find the latest Invesco NASDAQ ETF (QQQM) stock quote, history, news and other vital information to help you with your stock trading and investing. Learn everything about Invesco NASDAQ ETF (QQQM). News, analyses, holdings, benchmarks, and quotes. QQQM – Invesco NASDAQ ETF – Check QQQM price, review total assets, see historical growth, and review the analyst rating from Morningstar. Invesco NASDAQ ETF QQQM:NASDAQ. Last Price, Today's Change, Bid/Size, Ask/Size, Today's Volume. $, + (%), $/1. Invesco NASDAQ ETF. QQQM is passively managed to track a modified-market-cap weighted narrow index of NASDAQ-listed stocks, excluding financials. A high-level overview of Invesco NASDAQ ETF (QQQM) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. QQQM - Invesco NASDAQ ETF - Stock screener for investors and traders, financial visualizations.

Best Dividend Tracker App

Purple Brick is a dividend tracking app which helps you to keep track of all your investments and dividend payments. Purple Brick is the perfect tool for any. When developing Stockle, we had a vision to build a dividend tracker that is safe, easily manageable, understandable and actually fun to use. We. Dividend Tracker is one of the most useful apps for dividend investors. It allows you to track your investment portfolio and any changes in dividends. Track your XTB dividend. Portseido helps keep track of your portfolio performance, gains and dividends and visualizes it in an easy-to-use graph. Dividend stock portfolio tracker - track your dividends! Dividend calendar, dividend yield, yield on cost, automatic DRIP and dividend growth rate. The free dividend tracker. DiviTrack Tracks your dividend income and important metrics from stocks & etfs all in one place. Track Your Dividends is a stock dividend tracker app that is the easiest way to manage your dividend portfolios and ditch your spreadsheet. Dividend Tracking was never easier. Stock Events provides the most comprehensive dividend Get App. The bestDividend Tracker. Dividend Tracking was never. Track Your Dividends is a stock dividend tracker app that is the easiest way to manage your dividend portfolios and ditch your spreadsheet. Purple Brick is a dividend tracking app which helps you to keep track of all your investments and dividend payments. Purple Brick is the perfect tool for any. When developing Stockle, we had a vision to build a dividend tracker that is safe, easily manageable, understandable and actually fun to use. We. Dividend Tracker is one of the most useful apps for dividend investors. It allows you to track your investment portfolio and any changes in dividends. Track your XTB dividend. Portseido helps keep track of your portfolio performance, gains and dividends and visualizes it in an easy-to-use graph. Dividend stock portfolio tracker - track your dividends! Dividend calendar, dividend yield, yield on cost, automatic DRIP and dividend growth rate. The free dividend tracker. DiviTrack Tracks your dividend income and important metrics from stocks & etfs all in one place. Track Your Dividends is a stock dividend tracker app that is the easiest way to manage your dividend portfolios and ditch your spreadsheet. Dividend Tracking was never easier. Stock Events provides the most comprehensive dividend Get App. The bestDividend Tracker. Dividend Tracking was never. Track Your Dividends is a stock dividend tracker app that is the easiest way to manage your dividend portfolios and ditch your spreadsheet.

I'm using The Rich for iPhone. It's the only way I can track dividends across difference brokerages.

This article showcases the pros and cons of some top dividend tracker apps. We take a look into their features, overview, and the companies behind them. Purple Brick is the ultimate dividend tracking app that helps you keep track of your investment portfolio and stay on top of your dividend payouts. Whether you'. Best Dividend Tracker for Excel!! Take back control of your investments!! Tracks years of dividends!! Track 30 Positions!! It's easy to use and edit. All the. The Dividend Tracker gives dividend investor the tools to stay on top of their investments The Dividend Tracker is creating a better user. DivTracker is the easiest way to track your dividend income. View insights on your payouts, see your portfolios in one place, visualize your annual and. Best Dividend Tracker App htmltemplate.site htmltemplate.site is simple dividend tracker for a portfolio of any type and size – Saving you time and energy while planning for the future. Start tracking now. When developing Stockle, we had a vision to build a dividend tracker that is safe, easily manageable, understandable and actually fun to use. We. Correct FIFO tax reports, great support. I was looking for an app to solve a very common problem: FIFO PnL calculation with partial sales, as it is required. The Dividend Tracker, now in a mobile app! It's the easiest way to track your Dividend Portfolio and Dividend Income on the go. The Best FREE Dividend Tracker App on the internet. Quit using Excel and Start Tracking Your Dividend Portfolio Using a Modern Solution. Stock Dividend Tracker app allows you to create multiple lists of Best Dividend Stock App I Have Found So Far. Reviewed in the United States on. Since , our Dividend Safety Scores™ (97% of cuts avoided), elegant portfolio tracker It allowed me to confidently focus on buying high quality dividend. And when it comes to tracking your investments and dividends, htmltemplate.site dividend watch calculator stands out as the best choice with its powerful. htmltemplate.site's tools help investors make sound investment decisions. Investors can narrow down their stock investment search by screening, comparing and. The Best FREE Dividend Tracker App on the internet. Quit using Excel and Start Tracking Your Dividend Portfolio Using a Modern Solution. Website. Dividend Stock Portfolio Tracker · Welcome! Thanks for checking out my Dividend Stock Portfolio tracking spreadsheet. To get started please follow the directions. Watch your dividend yield grow. Optimize your portfolio with the best dividend stocks and discover the ones with the highest payouts. The dividend tracker helps. Dividend Tracker is a specialized application designed to assist savvy investors in managing and tracking their stock portfolio's dividend income with great.

Cash App Standard Deposit

cash app, but my bank has no record of this deposit. Cashapp closed the claim & insists the bank (chase) has it, the bank states they have. 3. Deposit Money Into Your Cash App Account Once the account is created, you'll be able to receive money from other users or transfer money into your Cash App. Cashing out for free is ACH, takes ~3 business days and goes to your linked bank account. For Instant, costs a percentage and goes through your. You can make standard deposits from your Cash App business account to your bank account for free. If you need the money instantly, say to cover a bill, then. With Instant Deposits, you may get $1, or more instantly available after you initiate a standard bank deposit into your investing or retirement accounts. Cash App allows check deposits for verified accounts with linked banks. · Daily deposit limit: $7, and monthly deposit limit: $15, standard option. The money is typically available in business days. $0. Instant Deposit; Fee for expedited transfer from your Cash App account to a linked. No minimum deposit to get started and get your money up to two business days sooner with early direct deposit.1 Same page link to footnote reference 1 · Get. Cash out standard deposits are fee-free and arrive within 1 to 3 business days into your bank account. Instant deposits cost % % - % with a minimum. cash app, but my bank has no record of this deposit. Cashapp closed the claim & insists the bank (chase) has it, the bank states they have. 3. Deposit Money Into Your Cash App Account Once the account is created, you'll be able to receive money from other users or transfer money into your Cash App. Cashing out for free is ACH, takes ~3 business days and goes to your linked bank account. For Instant, costs a percentage and goes through your. You can make standard deposits from your Cash App business account to your bank account for free. If you need the money instantly, say to cover a bill, then. With Instant Deposits, you may get $1, or more instantly available after you initiate a standard bank deposit into your investing or retirement accounts. Cash App allows check deposits for verified accounts with linked banks. · Daily deposit limit: $7, and monthly deposit limit: $15, standard option. The money is typically available in business days. $0. Instant Deposit; Fee for expedited transfer from your Cash App account to a linked. No minimum deposit to get started and get your money up to two business days sooner with early direct deposit.1 Same page link to footnote reference 1 · Get. Cash out standard deposits are fee-free and arrive within 1 to 3 business days into your bank account. Instant deposits cost % % - % with a minimum.

Learn more about Cash App direct deposit. Review transfer options. Square offers multiple ways to transfer your money. Standard next-business-day transfers. A minimum opening deposit of $ is required to open. How to maintain the rate: Deposit at least $25, within 30 days of account opening and maintain a. CashApp funds deposit to the linked bank account, just like other accounts. For instance, a person using Instant Deposit for their Square balance, doesn't. For example, if you want to make a standard transfer from your Cash App If you set up a direct deposit and receive more than $ per month in your. Direct deposits can take between 1–5 business days to arrive in your Cash App from the scheduled arrival date. Cash App only deducts processing fees once you start using Cash for Business to accept customer payments. How to Set Up Direct Deposit Your Cash App can receive individual direct deposits up to $25, and daily cumulative direct deposits up to $50, You can. There is no fee for a standard deposit to a user's linked bank account. However, the transaction can take one to three business days. Cash App Instant Transfer. deposit speed, and just click 'Cash Out'. Understanding Deposit Speeds. When transferring money, you have two-speed options: Standard Deposit. Standard deposits can take one to three days to post, making it essential to plan your cash flow carefully. Cash App can delay payments or increase fees if. Cash Out (standard); No fee to transfer money from your Cash App account to a linked account with the standard option. The money is typically available in Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. Set up Direct Deposits and start receiving your paychecks with Cash App. You can receive up to $25, per direct deposit, and up to $50, in a hour period. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. Tap “Cash Out,” then select a deposit speed. For your CARD account, select “Instant,” as standard delivery is not. How to change my card on Cash App? Tap the. The money is typically available in business days. $0. Instant Deposit. Fee for expedited transfer from your Cash App account to a linked account. Funds are. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're deposit in our mobile banking app. With our standard funds availability, deposits. Another thing to note is that Cash App is compliant with Level 1 of the Payment Card Industry Data Security Standard. Sounds fancy, right? That means it. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. PayPal, Venmo, and Cash App all offer two kinds of deposits – first, the standard bank transfer and second, the Instant Deposit or Transfer. Standard bank.

Mortgage Rate Comparisons

Better Mortgage's loan comparison calculator lets you compare two fixed-rate options to decide which is best for you. Mortgage Loan Type: Rate Information: ; Conventional, Rate depends on down payment and credit score ; Fixed-Rate, Rates remain the same throughout the life of the. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. Compare mortgage interest rates and terms and find a mortgage that suits your needs. We're here to help with your home buying needs. MoneySuperMarket can help you compare thousands of mortgage products from a wide variety of lenders, covering the whole of the market. Home Purchase Center. Mortgage rates as of September 13, year fixed; year fixed. Compare today's mortgage rates across home loan lenders and choose one that best fits your needs. Current Mountain View Thirty Year Mortgage Rates ; District Lending. NMLS # · % ; Solidify Mortgage Advisors. NMLS # · % ; Equity Capital. September mortgage rates currently average % for year fixed loans and % for year fixed loans. Better Mortgage's loan comparison calculator lets you compare two fixed-rate options to decide which is best for you. Mortgage Loan Type: Rate Information: ; Conventional, Rate depends on down payment and credit score ; Fixed-Rate, Rates remain the same throughout the life of the. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. Compare mortgage interest rates and terms and find a mortgage that suits your needs. We're here to help with your home buying needs. MoneySuperMarket can help you compare thousands of mortgage products from a wide variety of lenders, covering the whole of the market. Home Purchase Center. Mortgage rates as of September 13, year fixed; year fixed. Compare today's mortgage rates across home loan lenders and choose one that best fits your needs. Current Mountain View Thirty Year Mortgage Rates ; District Lending. NMLS # · % ; Solidify Mortgage Advisors. NMLS # · % ; Equity Capital. September mortgage rates currently average % for year fixed loans and % for year fixed loans.

A lower rate gives you more savings than merely a lower monthly payment. The real savings is both the interest saved, plus the additional principal paid down. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. 8 calculators to compare mortgages, from ditching your fix to saving for a deposit. Choose a calculator (scroll for more). Compare the best mortgage rates and deals. Compare today's live mortgage rates from our lender panel. The interest rates you're shown are an indication only; to. Compare today's mortgage rates and get a customized quote from a lender that fits your needs. Get mortgage rates quotes for buying or refinancing and see side by side comparisons of available lending options. Find out what you qualify for today! Mortgage Loan Type: Rate Information: ; Conventional, Rate depends on down payment and credit score ; Fixed-Rate, Rates remain the same throughout the life of the. The Big Five Banks hold 74% of all mortgages in Toronto, with other banks, such as HSBC, at %, credit unions at %, and Ontario private mortgage lenders at. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. A mortgage rate is the interest rate you pay on the money you borrow to buy property. Compare today's mortgage rates for purchase and refinance and lock in. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Looking for the best mortgage rates in Canada? nesto offers competitive rates and personalized service to help you find the perfect mortgage. This mortgage calculator lets you quickly compare the cost of two different mortgage rates. Where are mortgage rates headed? ; Current rate, %, March 28, ; This time last year, %, March 30, ; Highest point in last decade, %, Oct. Just check the rates at your local savings banks and credit unions. 30 yr fixed and 5/1 or 3/1 ARMS are what you want to compare. Sometimes USDA. Compare the best current mortgage interest rates in Canada for free. On average, Canadians save thousands of dollars per year comparing mortgage rates with. This comparison tool searches the whole market for mortgages that match your needs. If you find a deal you like, we can help you apply for free. This mortgage calculator lets you quickly compare the cost of two different mortgage rates. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for As of Sept. 13, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %.

How Does A 1031 Tax Exchange Work

A exchange is a tax-deferred exchange that allows you to defer capital gains taxes as long as you are purchasing another “like-kind” property. This. A exchange allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time. IRC Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a. First of all, to provide a brief refresher on what a exchange is -- IRS Code Section grants investors the opportunity to defer capital gains taxes on. IRC Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a. A exchange is a tax strategy that allows investors to sell an investment property in exchange for another property, then defer capital gains from the. exchanges allow real estate investors to defer paying capital gains tax when the proceeds from real estate sold are used to buy replacement real estate. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. In a tax deferred exchange. A exchange is governed by Code Section as well as various IRS Regulations and Rulings. Section provides that “No gain or loss shall be recognized. A exchange is a tax-deferred exchange that allows you to defer capital gains taxes as long as you are purchasing another “like-kind” property. This. A exchange allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time. IRC Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a. First of all, to provide a brief refresher on what a exchange is -- IRS Code Section grants investors the opportunity to defer capital gains taxes on. IRC Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a. A exchange is a tax strategy that allows investors to sell an investment property in exchange for another property, then defer capital gains from the. exchanges allow real estate investors to defer paying capital gains tax when the proceeds from real estate sold are used to buy replacement real estate. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. In a tax deferred exchange. A exchange is governed by Code Section as well as various IRS Regulations and Rulings. Section provides that “No gain or loss shall be recognized.

In a Reverse Exchange (reverse exchange), the investor first purchases the Replacement Property and then sells the property. To further illustrate how this. The funds are directly used to purchase the replacement property. Because the taxpayer never actually gains the proceeds from the sale, they may defer the tax. A exchange allows real estate investors to swap one investment property for another and defer capital gains taxes, but only if IRS rules are met. A exchange is very straightforward. If a business owner has property they currently own, they can sell that property, and if they reinvest the proceeds. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. It's important to keep in mind. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. How do Exchanges work? In real estate, a exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. A. Taxes are an inevitable part of real estate investing. You can, however, defer or avoid paying capital gains taxes by following some simple exchange rules. How Does a Exchange Work? A exchange works by allowing you to exchange the tax liability from selling one investment property for the commitment to. 1. Exchanges are Tax-Deferred, Not Tax-Free · 2. Taxes May Be Deferred Forever · 3. Section Does Not Apply to Primary Homes · 4. Exchange Must Be “Like-. The whole point of the Exchange is moving investment money forward to invest in more property. Pulling money out tax free prior to the exchange would. Tax Deferred Exchanges allow you to keep % of your money (equity) working for you instead of paying (losing) about one-third (1/3) of your funds (equity). What Are the Rules for a Exchange? · The exchange must be set up before a sale occurs · The exchange must be for like-kind property · The exchange property. A tax-deferred exchange allows you to dispose of investment properties and acquire “like-kind” properties, allowing you to reinvest sales proceeds that. Remember, a Exchange does not just defer long-term capital gains taxes. Use your imagination. How does a exchange work? To execute a successful. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange. A transition rule in the new law provides that Section Because a Exchange is considered a swap, you need to designate the next property shortly after selling the first property. According to the IRS, “you have. A Exchange allows a taxpayer to defer % of their capital gain tax liability. To do this, the exchanger must buy new Replacement Property equal to or. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. In a tax deferred exchange. It enables you to defer capital gains tax and depreciation recapture by reinvesting the proceeds from the sale of investment property into replacement property.