htmltemplate.site Community

Community

Advantages And Disadvantages Of Leasing A Vehicle

Disadvantages Of Leasing A Car. Some drawbacks of leasing a car include: Expensive Over The Long Term. There are cost differences associated with leasing vs. The initial cost to lease a vehicle is typically lower than the down payment required to buy the same vehicle, according to the car value website htmltemplate.site Leasing a car means you'll have lower monthly payments and you can typically drive a vehicle that may be more expensive than you could afford to buy. Advantages of Leasing Lower Monthly Payments- When leasing, you only make payments based on the depreciation of your vehicle during the leasing period. With leased vehicles, these depreciation benefits are accrued by the leasing company. Another consideration is that different types of lease agreements have. What are the drawbacks of car leasing? - If you can no longer meet the repayments and default, you could risk the car being repossessed. Realistic budgeting. 8 Biggest Disadvantages to Leasing a Car · 1. Expensive in the Long Run · 2. Limited Mileage · 3. High Insurance Cost · 4. Confusing · 5. Hard to Cancel · 6. Requires. There are Mileage Limits: Frequent Drivers Beware If you drive more than 15, miles a year, then leasing may be a disadvantage to your wallet. Leasing. 8 Biggest Disadvantages to Leasing a Car · 1. Expensive in the Long Run · 2. Limited Mileage · 3. High Insurance Cost · 4. Confusing · 5. Hard to Cancel · 6. Requires. Disadvantages Of Leasing A Car. Some drawbacks of leasing a car include: Expensive Over The Long Term. There are cost differences associated with leasing vs. The initial cost to lease a vehicle is typically lower than the down payment required to buy the same vehicle, according to the car value website htmltemplate.site Leasing a car means you'll have lower monthly payments and you can typically drive a vehicle that may be more expensive than you could afford to buy. Advantages of Leasing Lower Monthly Payments- When leasing, you only make payments based on the depreciation of your vehicle during the leasing period. With leased vehicles, these depreciation benefits are accrued by the leasing company. Another consideration is that different types of lease agreements have. What are the drawbacks of car leasing? - If you can no longer meet the repayments and default, you could risk the car being repossessed. Realistic budgeting. 8 Biggest Disadvantages to Leasing a Car · 1. Expensive in the Long Run · 2. Limited Mileage · 3. High Insurance Cost · 4. Confusing · 5. Hard to Cancel · 6. Requires. There are Mileage Limits: Frequent Drivers Beware If you drive more than 15, miles a year, then leasing may be a disadvantage to your wallet. Leasing. 8 Biggest Disadvantages to Leasing a Car · 1. Expensive in the Long Run · 2. Limited Mileage · 3. High Insurance Cost · 4. Confusing · 5. Hard to Cancel · 6. Requires.

However, if you prefer to change cars every few years and have a new vehicle under the manufacturer's warranty, leasing is a much better option. That's because. Typically, leased cars are covered by the manufacturer's warranty and include free oil changes and other, covered repairs. A safer vehicle. Leasing a car allows. What are the advantages/disadvantages to buying vs leasing? · You own the vehicle · No mileage restrictions · Freedom to customize it. Leasing is a waste of money unless you can write off the cost, like with a business. It's similar to a Netflix subscription, except sometimes a. Upgrade often: Leasing a car gives you the flexibility to upgrade your vehicle more frequently. · Lower payments: All things being equal, the monthly payment on. Weighing the advantages and disadvantages of leasing vs. buying · Likely a down payment required · Higher monthly payments · Often purchasing a less desirable make. Most lease vehicles are new, so you'll have the standard maintenance costs and will have to keep the car in great condition or risk penalties when you return it. This freedom isn't available when leasing a vehicle. Disadvantages of Financing. Higher Monthly Payments: Financing typically comes with higher monthly payments. First, and perhaps most important, choosing a lease means having a much lower monthly payment than you'd receive with a typical car loan. This means you can. Leasing may be a good option for you if you want a vehicle with the latest safety features but cannot afford to purchase a new vehicle. Although there are many advantages to leasing a car, there are also some disadvantages. For starters, leasing means you don't actually own the vehicle. This. The advantage is that the car is yours - no mileage limitations, you can customize it, whatever. The disadvantage is that the car is yours. What are the drawbacks of car leasing? - If you can no longer meet the repayments and default, you could risk the car being repossessed. Realistic budgeting. Autoflex Leasing makes things easy by offering flexible auto leasing deals and the simplest process on the market. Get an auto lease quote today! You dont own the vehicle at the end of the lease and should you want to settle early or go over your contracted mileage additional fees are applicable. What are. While purchasing delivers ownership equity and long-term cost savings, leasing offers reduced monthly payments and the chance to drive frequently-released. To protect themselves, leasing companies set the value toward the low end of the range on used-car leases. This way they don't end up with an overvalued car at. Leasing is a waste of money unless you can write off the cost, like with a business. It's similar to a Netflix subscription, except sometimes a. The main drawbacks of leasing are: If you go over your mileage limitations as agreed upon at the start of your lease term, you'll be required to pay hefty.

Lowest Fha Interest Rate

Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. National year fixed FHA mortgage rates remain stable at %. The current average year fixed FHA mortgage rate remained stable at % on Wednesday. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. View our rates and crunch your numbers to see what works best with your budget. Not sure which mortgage is right for you? Find your Mortgage Match with our. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Compare FHA mortgage rates today from major lenders. NerdWallet's FHA loan interest rate is based on a daily survey of national lenders. Current FHA mortgage rates are % for a 30 year fixed rate loan and NA for a 15 year fixed loan. Today's FHA Loan Rates ; % · % · Year Fixed · %. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. National year fixed FHA mortgage rates remain stable at %. The current average year fixed FHA mortgage rate remained stable at % on Wednesday. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. View our rates and crunch your numbers to see what works best with your budget. Not sure which mortgage is right for you? Find your Mortgage Match with our. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Compare FHA mortgage rates today from major lenders. NerdWallet's FHA loan interest rate is based on a daily survey of national lenders. Current FHA mortgage rates are % for a 30 year fixed rate loan and NA for a 15 year fixed loan. Today's FHA Loan Rates ; % · % · Year Fixed · %.

Today's FHA Mortgage Rates As of September 5, , the average FHA mortgage APR is %. Terms Explained.

Year Fixed Rate Mortgage Average in the United States. Related Categories. Mortgage Rates Interest Rates Money, Banking, & Finance. Releases. More Series. Homebuyer Mortgage Interest Rates ; (k) Limited Rehabilitation Mortgage. , N/A ; Note: Additional fees may apply to the FHA (k) Rehabilitation Programs. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps. AHFC interest rates are posted daily Monday to Friday, excluding state holidays. Rates are valid each business day up to until 10pm. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Which loan works best for you? Calculators. Which lender has the better loan? Should I pay points to lower the rate? What will my closing costs. SONYMA's Low Interest Rate Programs (Year Mortgage) ; Achieving the Dream Mortgage Program ; Current Interest Rate (short-term lock-in rate), %, %. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from htmltemplate.site FHA. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. You can choose between a year and year term – with either a fixed or variable interest rate. Shorter Waiting Periods. You may qualify for an FHA loan. Today's rates for a year, fixed-rate FHA loan start at % (% APR), according to The Mortgage Reports' daily rate survey. Rates on FHA loans have moved around a lot in recent years — from less than 3 percent during the pandemic to 8 percent in October For most of early How does an FHA Loan compare to other Elements mortgage options? ; Interest Rate As Low As. Purchase: % for Year Fixed. Refinance: % for Year. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ Government Insured FHA/VA/RD ; FirstHome, Program: FirstHome Rate: ; FirstHome Plus, Program: FirstHome Plus Rate: ; FirstHome w/ 2nd Loan, Program. FHA Mortgage Rates ; FHA Year Fixed *, %, % ; FHA Year Fixed *, %, % ; FHA Year Fixed *, %, % ; FHA Year Fixed *, %. Which loan works best for you? Calculators. Which lender has the better loan? Should I pay points to lower the rate? What will my closing costs. How to Get a Lower Interest Rate on Your FHA Mortgage: Credit Scores If you Do this in conjunction with the advice given above for best results. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. First-time homebuyer & FHA ; 7/6 first-time homebuyer adjustable rate mortgage · % · % ; year FHA · % · %.

Hrv Magic Seat

Performance: horsepower, liter, In-line 4-cylinder engine, and 29 combined MPG. Amenities: Standard heated front seats, 2nd-row magic seat®, and leather. Magic Seat®, and more. What driver assistance features does the new Honda HR-V offer? The new Honda HR-V comes loaded with Honda Sensing® Safety. Magic seats are Hondas secret sauce in their compact cars/SUVs. The back seat can fold forward for a fully flat surface in the back, of the butt. Magic Seat®. Here's a breakdown of the Honda HR-V seating room: Passenger Volume: cubic feet; Front Headroom: inches; Front Shoulder Room: This vehicle's Magic Seat® provides an extraordinary degree of versatility for hauling passengers and cargo. It offers Tall Mode, Utility Mode and Long Mode. The new model retains some of its best features, including practicality but loses some fantastic features, such as the second-row Magic seat. The new HR-V. The Honda HR-V seating ensures a comfortable ride for up to five passengers on Webster roads. The HR-V's versatile 60/40 Split 2nd-Row Magic Seat® makes it. If you have longer items, like a kayak, to fit inside your HR-V, use the long mode of the Magic Seat® feature, where you can fold down the rear seats as well as. Adjusting the Front Seats. Always make seat adjustments before driving. Adjust the driver's seat as far back as possible while allowing you to maintain full. Performance: horsepower, liter, In-line 4-cylinder engine, and 29 combined MPG. Amenities: Standard heated front seats, 2nd-row magic seat®, and leather. Magic Seat®, and more. What driver assistance features does the new Honda HR-V offer? The new Honda HR-V comes loaded with Honda Sensing® Safety. Magic seats are Hondas secret sauce in their compact cars/SUVs. The back seat can fold forward for a fully flat surface in the back, of the butt. Magic Seat®. Here's a breakdown of the Honda HR-V seating room: Passenger Volume: cubic feet; Front Headroom: inches; Front Shoulder Room: This vehicle's Magic Seat® provides an extraordinary degree of versatility for hauling passengers and cargo. It offers Tall Mode, Utility Mode and Long Mode. The new model retains some of its best features, including practicality but loses some fantastic features, such as the second-row Magic seat. The new HR-V. The Honda HR-V seating ensures a comfortable ride for up to five passengers on Webster roads. The HR-V's versatile 60/40 Split 2nd-Row Magic Seat® makes it. If you have longer items, like a kayak, to fit inside your HR-V, use the long mode of the Magic Seat® feature, where you can fold down the rear seats as well as. Adjusting the Front Seats. Always make seat adjustments before driving. Adjust the driver's seat as far back as possible while allowing you to maintain full.

You can also fold Honda's rear Magic Seat various ways to make stowing larger items easier. READ MORE. “The HR-V's party trick is its second-row Magic Seat. The rear seats of the Honda HR-V have another trick up their sleeves! Named 'Magic Seats' the rear seat bases can be raised up to give great storage if you. Magic seats are Hondas secret sauce in their compact cars/SUVs. The back seat can fold forward for a fully flat surface in the back, of the butt. With the seatbacks up and the seat bottom down, HR-V provides room in the rear for up to three passengers to cruise comfortably. I'm 6 feet one. With both seats fully forward I can lay flat on a full size air mattress. We love the magic seat and all their options. I've actually. The magic seat system is a big draw for me. Combined with the 6-speed manual transmission, more power than the Fit, and the economy of Honda--I have high hopes. Honda HR-V. 2nd-Row Magic Seat® Standard. Walk Away Auto Lock® Standard. Heated Front Seats Standard. Collision Mitigation Braking System™ Standard. HR-V is gone in this iteration. Honda's so-called Magic Seat, which let users flip up the rear seat bottoms to store tall items on the floor, is no more. A Second-Row Magic Seat makes the Honda HR-V incredibly versatile, allowing you to carry both passengers and cargo easily. The HR-V is also loaded with. Magic Seat®, Walk Away Auto Lock®, and heated front seats. HR-V LX. HR-V LX. Starting MSRP 24, hp, Liter Engine; 60/40 Split 2nd-Row Magic Seat. Especially impressive is Honda's rear Magic Seat. With four different seat configurations, the Magic Seat allows the HR-V to carry bags, bikes, and even an seats. You can fold the front passenger's seat down, along with the Magic Seat®, which allows your HR-V to fit cargo up to 8 feet long. See the accompanying. As shown in the picture: The weather has turned cold, but I will be warm, thanks to the seat warmer in my hot new Honda CR-V from Proctor's Honda. ” Sandra. Performance: horsepower, liter, In-line 4-cylinder engine, and 29 combined MPG. Amenities: Standard heated front seats, 2nd-row magic seat®, and leather. 60/40 Split 2nd-Row Magic Seat. Honda HR-V Sport: HR-V Sport models offers several feature upgrades, plus exclusive sporty styling and performance elements like. The Cargo Space Your Family Needs · The Magic of the 2nd Row Magic Seat® · Get a Honda HR-V Today! Across all configurations, the HR-V sports a cabin that is ideal for road trips, offering a versatile 60/40 Split 2nd-Row Magic Seat® for easy cargo access. HR-V is one of the most efficient and versatile crossovers in the Honda Honda's Magic Seat®. Honda's 60/40 split second-row seat allows for multiple. Honda went so far as to call that the magic seat. And that was the result of the gas tank, instead of being somewhere around here, being under the front seats. From the Magic Seat system to an advanced infotainment system, there are many premium features that make the HR-V one of the best crossover options on the.

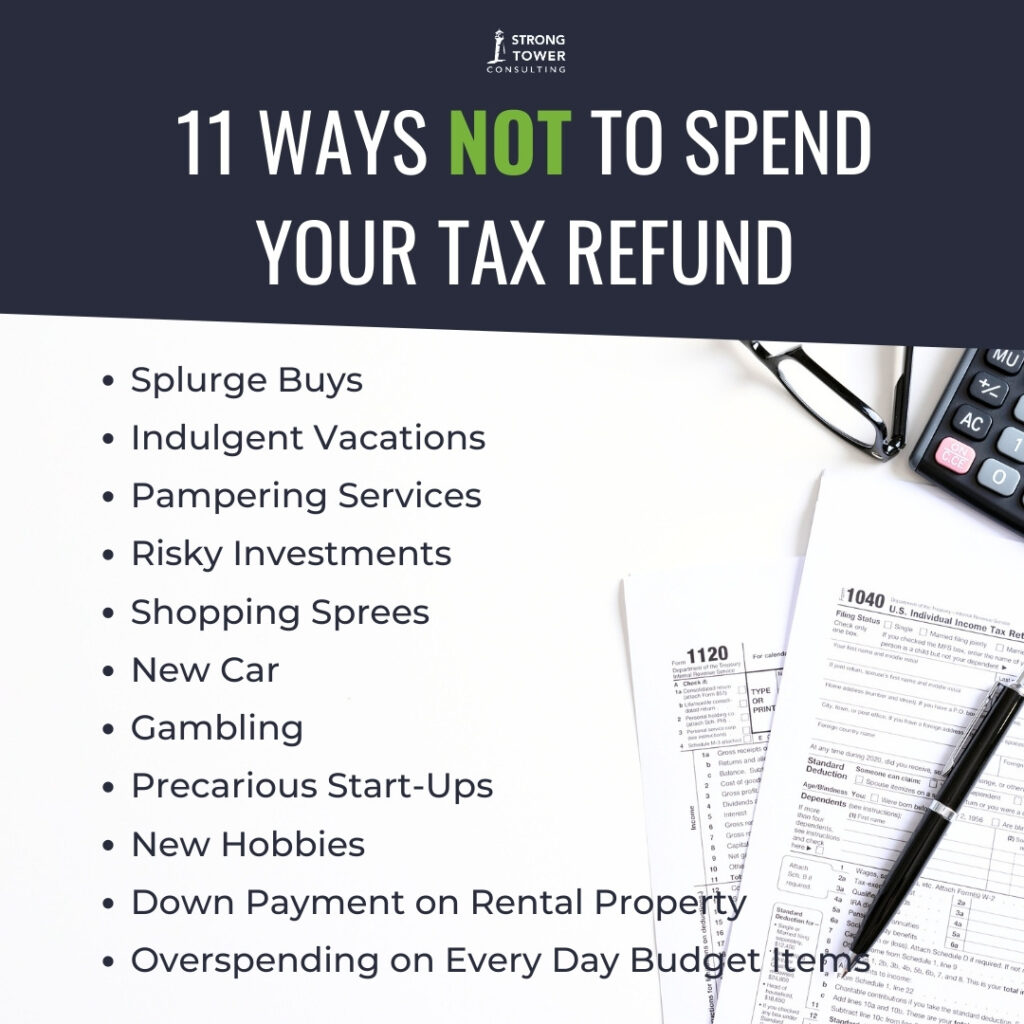

Why Do I Never Get A Tax Refund

If you file your return after March 31, wait four weeks before contacting us. We do not pay refunds of less than $2. End of note. Direct deposit of your refund. If you didn't account for each job across your W-4s, you may not have withheld enough, so your tax refund could be less than expected in Or, if you had a. We issue most refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your. Why? Some tax returns take longer to process than others for many reasons, including when a return: Includes calculation errors. Is incomplete or illegible. Processing of selected tax returns is estimated to take up to eight weeks. To whom do I make my payment payable? Make your check or money order payable to the ". You'll get IRS notice CP49,Overpayment Applied to Taxes Owed. If you don't think you owed what the IRS says you owed, the only thing you can do is file an. You get your overpayment back as a tax refund but you're essentially making What you do with this additional cash flow depends on your situation. Change your address on your next tax return. Contact us. How long does an "apportionment of a refund" take. The information provided here is the same you would receive by calling the CRA T2 Corporation income tax return – electronic. T3 trust returns. GST/HST. If you file your return after March 31, wait four weeks before contacting us. We do not pay refunds of less than $2. End of note. Direct deposit of your refund. If you didn't account for each job across your W-4s, you may not have withheld enough, so your tax refund could be less than expected in Or, if you had a. We issue most refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your. Why? Some tax returns take longer to process than others for many reasons, including when a return: Includes calculation errors. Is incomplete or illegible. Processing of selected tax returns is estimated to take up to eight weeks. To whom do I make my payment payable? Make your check or money order payable to the ". You'll get IRS notice CP49,Overpayment Applied to Taxes Owed. If you don't think you owed what the IRS says you owed, the only thing you can do is file an. You get your overpayment back as a tax refund but you're essentially making What you do with this additional cash flow depends on your situation. Change your address on your next tax return. Contact us. How long does an "apportionment of a refund" take. The information provided here is the same you would receive by calling the CRA T2 Corporation income tax return – electronic. T3 trust returns. GST/HST.

To receive a timely refund for the appropriate amount and to avoid owing additional tax, penalty and interest, you should thoroughly review your return before. If it has been more than 10 days since your refund check has been mailed and you have not received it, please call the Comptroller's Office for assistance at. You will receive refund interest if the refund is Direct deposit of an income tax refund is only available for original returns filed electronically. If you requested Direct Deposit on your Colorado state income tax return and did not receive it, you should first contact the bank or financial institution. The most common reason would be having other sources of income. For example, if you also have significant income from interest, dividends, or. Returned Refund Checks. The Department of Revenue receives over 6, returned individual income tax refund checks each year. How Do I? Customer Service. Did not receive refund, or refund check was lost or damaged If you haven't received your refund yet, allow enough time to process your tax return If you. A refund just means you withheld too much from your paycheck, while an additional tax liability means you didn't withhold enough. A refund just means you withheld too much from your paycheck, while an additional tax liability means you didn't withhold enough. Some tax returns take longer to process than others for many reasons, including when a return: · Is sent by mail · Contains errors or is incomplete · Needs further. 1. Working a second job · 2. Your employer is not withholding enough tax · 3. You have existing government debts · 4. Claiming the tax-free threshold for multiple. Find Your Illinois Tax Refund System. What do I do if my refund is different than what was shown on my return? I have not received my refund check. Although we try to process your refund within the timeframes stated above, it may take longer due to our rigorous fraud detection procedures. Each year, the. Check your refund status · How long will it take to get your refund? · What can slow down your refund? · Why did we make a change to your refund? It can take up to 10 working days for your repayment to reach your bank account, once requested. If you still have not received it after this, contact us by. Your refund is being held because of a prior year tax liability. Examples: Income Tax, Sales Tax, Withholding Tax, etc. Also, if you owe for child support. Refunds. How do I check the status of my New Jersey Income Tax refund? You can get information about your New Jersey Income Tax refund online or by phone. My refund was issued over 2 weeks ago and I have not received it. What should I do? · Verify refund mailing address on your return was correct · Verify direct. Most refund checks have already been issued, but it is never too late to check! HB allows for a tax refund out of the State's surplus to Georgia filers who.

Apply For Costco Credit Card In Store

Apply for the Costco Anywhere Visa® Business Credit Card by Citi, a business credit card designed for Costco members, and earn cash back for business. FICO® Score: Citi credit card customers can view their FICO® Score for free On another note, they need to reconsider the quality of their Costco Citi Visa. There are three ways to apply: Stop by the membership counter at your local Costco warehouse and ask for an application. Apply on I haven't received my new. The Costco Anywhere cards is available only to Costco members. The fee for becoming a Costco member is, at a minimum, $60 per year. The benefits. What is the fastest way to get to use the Citi card? If I go to the store and apply, do they do approvals on the spot? Carry fewer cards. Your credit card is also your Costco membership card with all membership details on the back. You have to be a Costco member While the card itself has no annual fee, cardholders must have a paid Costco membership, which starts at $60 for Gold Star and. While most store credit cards fail to provide savings for everyday purchases, the Costco Anywhere Visa Card by Citi provides immense value for those who shop. In Store: Visit a local Costco store and let a representative know that you would like to apply for the Costco Credit Card. Then, fill out the application. Apply for the Costco Anywhere Visa® Business Credit Card by Citi, a business credit card designed for Costco members, and earn cash back for business. FICO® Score: Citi credit card customers can view their FICO® Score for free On another note, they need to reconsider the quality of their Costco Citi Visa. There are three ways to apply: Stop by the membership counter at your local Costco warehouse and ask for an application. Apply on I haven't received my new. The Costco Anywhere cards is available only to Costco members. The fee for becoming a Costco member is, at a minimum, $60 per year. The benefits. What is the fastest way to get to use the Citi card? If I go to the store and apply, do they do approvals on the spot? Carry fewer cards. Your credit card is also your Costco membership card with all membership details on the back. You have to be a Costco member While the card itself has no annual fee, cardholders must have a paid Costco membership, which starts at $60 for Gold Star and. While most store credit cards fail to provide savings for everyday purchases, the Costco Anywhere Visa Card by Citi provides immense value for those who shop. In Store: Visit a local Costco store and let a representative know that you would like to apply for the Costco Credit Card. Then, fill out the application.

The Costco Anywhere cards is available only to Costco members. The fee for becoming a Costco member is, at a minimum, $60 per year. The benefits. Carry fewer cards. Your credit card is also your Costco membership card with all membership details on the back. Learn how to apply for the Verizon Visa Card and if approved, use it to earn Verizon Dollars to pay your Verizon wireless or Verizon Fios bills or buy devices. Costco Anywhere Visa® Card by Citi. Anywhere Visa® Card by Citi. Pricing & Information Benefit Terms & Conditions · APPLY NOW. Call to Apply TTY. Apply for Costco Anywhere Visa® Credit Card by Citi, one of Citi's Best Cash Back Rewards Cards Designed Exclusively for Costco Members. There are three ways to apply: Stop by the membership counter at your local Costco warehouse and ask for an application. Apply on My Costco Anywhere Visa®. Credit card with a free annual fee for the first year and a high return rate for Costco members! You can get rewards for usage at Costco stores and other. This cash-back card doesn't have an annual fee, but you'll need a Costco membership to apply. There are two levels of Costco membership which cost $60 or $ For Costco Travel Vacation Package purchases, you must call and speak with a travel expert to apply your Digital Costco Shop Card as payment. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. The Costco Anywhere Visa® Card doubles as your membership card, complete with your picture and membership number. Show the card at the warehouse entrance, then. No, you do not need the Costco Anywhere Visa® Card by Citi to shop at Costco. All Visa branded cards will be accepted at Costco. cards at Costco is that the wholesale club is not considered a grocery store. credit card rewards when you shop there,” explains Schulz. “The same thing. Costco only accepts Visa credit cards in store, but also accepts Mastercard and Discover online and through the Costco app. U.S. Costco warehouse clubs and gas stations don't accept non-Visa cards. That means no American Express, Mastercard, or Discover cards for in-store purchases. here Or, visit htmltemplate.site and enter "Citi Visa" into the search bar. Call My Costco Anywhere Visa® Card by Citi isn't working, what do I do. To apply for a Costco credit card, you need to be a Costco member. Remember that the membership comes with an annual fee. Consider whether you are already a. Requires a Costco membership · Inconvenient redemption process with limited options · $7, cap on gas/EV charging bonus · No sign-up bonus. Digital Shop Cards can be accessed by clicking the “Access Card Now” button in the digital email. This. Payment processing solutions for Costco members. Accept debit and credit cards at exclusive pricing for Costco members.

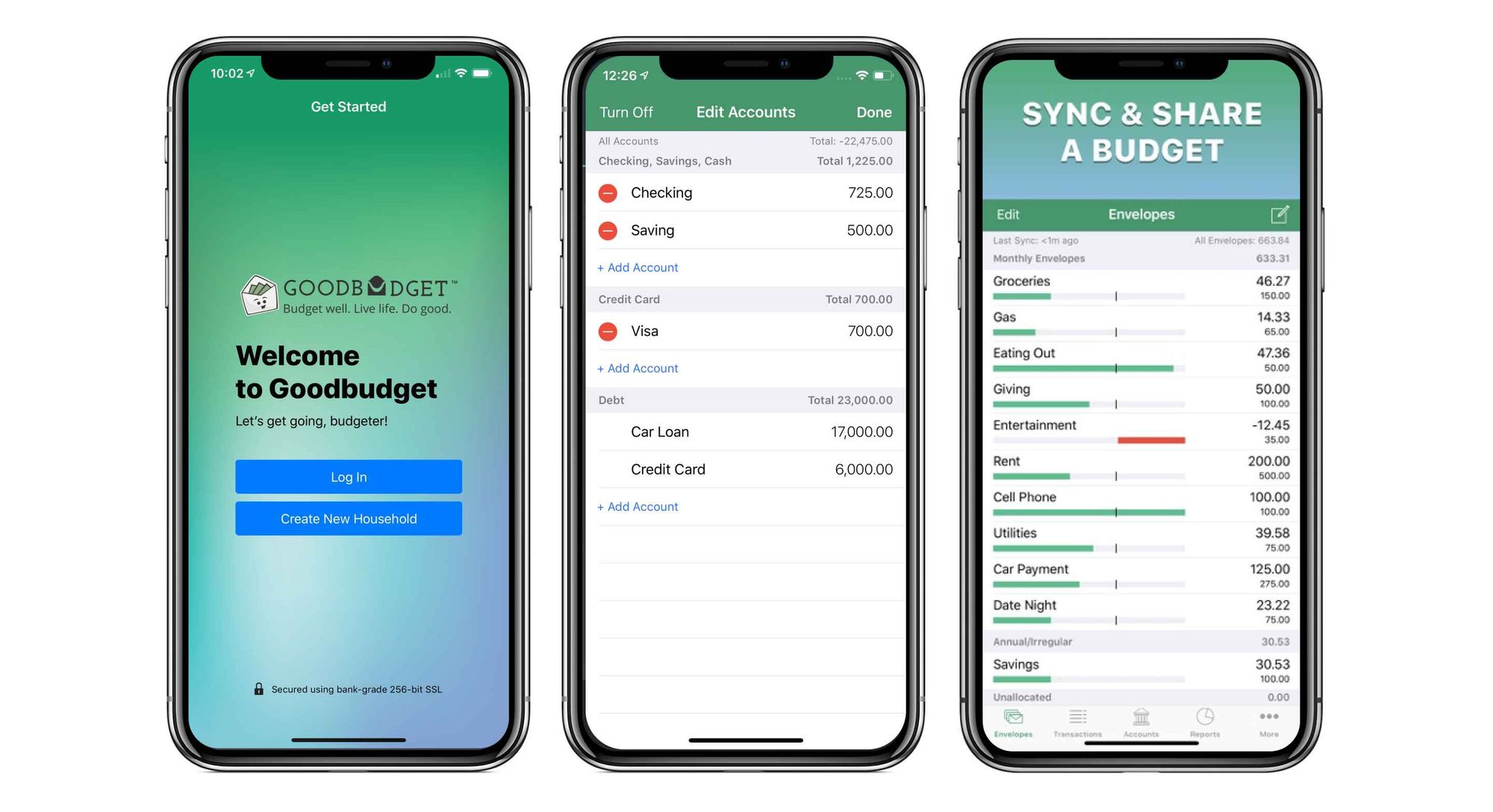

Top Personal Budget Apps

Quicken Simplifi is among the best budgeting apps you can download. It's robust, yet easy to use. With customizable tools, Simplifi lets you see where you've. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. Best app for planners: Simplifi by Quicken ; Best app for serious budgeters: You Need a Budget (YNAB) ; Best app for investors: Empower ; Best for being easy. Unlike traditional complicated budgeting apps, Daily Budget Original focuses on being simple, easy and actually fun to use. One of the more established and well known free budgeting apps in its market is Mint. Mint offers a range of tools that allows you to handle your finances. Another great app to help you budget is Personal Capital. It comes with free budgeting software and also includes tools to help you track your spending, wealth. EveryDollar is a straightforward, easy-to-use budgeting app that allows users to create a customizable budget and set savings goals. Users can opt to upgrade to. Money Manager Expense & Budget ” is an optimized application for personal apps at the same time to discover which one was the best to keep. I. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Quicken Simplifi is among the best budgeting apps you can download. It's robust, yet easy to use. With customizable tools, Simplifi lets you see where you've. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. Best app for planners: Simplifi by Quicken ; Best app for serious budgeters: You Need a Budget (YNAB) ; Best app for investors: Empower ; Best for being easy. Unlike traditional complicated budgeting apps, Daily Budget Original focuses on being simple, easy and actually fun to use. One of the more established and well known free budgeting apps in its market is Mint. Mint offers a range of tools that allows you to handle your finances. Another great app to help you budget is Personal Capital. It comes with free budgeting software and also includes tools to help you track your spending, wealth. EveryDollar is a straightforward, easy-to-use budgeting app that allows users to create a customizable budget and set savings goals. Users can opt to upgrade to. Money Manager Expense & Budget ” is an optimized application for personal apps at the same time to discover which one was the best to keep. I. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB.

General overview: PocketGuard is a standout among the best budgeting apps for its ease of use and practical features. This personal finance management app. Empower: Best for portfolio management. Empower, known prior as Personal Capital, is one of the best investment and budgeting tools available to deliver an. The 4 best budgeting apps ; Mint · Free. ; You Need a Budget (YNAB) · Free day trial (no credit card required). After that, the app costs $ per month or an. Our guide ranks the best budget apps for New Zealanders, including PocketSmith, CashNav, MoneyLover and more, to help avoid the problem of running out of. Planning - Budget and Lifetime Planner (which is a retirement forecaster). Works for me, I've been using it since and it takes about Empower (formerly Personal Capital) is for the couple who is serious about their future together — particularly their financial future. Moneyhub is a comprehensive but simple to use budgeting app which provides one of the most accurate evaluations of your net worth. Unlike other apps, it factors. What is the Best Personal Budgeting App? · Mint · Wally · BudgetSimple · PocketGuard. Guap is a cute and very simple budget planner. The app helps you easily track your expenses and income. You can easily view statistics for any period. The best budgeting app for you will depend largely on your preferences and personal goals. Here's a look at nine money-management apps and where each excels. My wife and I use Mint to track out joint accounts as well as personal accounts (from pre-marriage). We like Mint because it allows us to. General overview: PocketGuard is a standout among the best budgeting apps for its ease of use and practical features. This personal finance management app. Mint: Best Budgeting Software for Businesses on a Budget. Although Mint is technically a personal finance app that's best for tracking expenses, its user. You Need a Budget or YNAB earns the top spot on our list because of the company's renowned budgeting philosophy and reputation. One of the more established and well known free budgeting apps in its market is Mint. Mint offers a range of tools that allows you to handle your finances. Budget Planner on the go! Your Ultimate Monthly Budget Planner and Daily Expense Tracker! Are you tired of financial stress and complex money management. YNAB is ideal for people who have debts to pay off or savings goals they want to reach. It helps you spend smarter with tools like budget creation, goal. Money Manager - the #1 financial planning, review, expense tracking, and personal asset management app for Android! Money Manager makes managing personal. Editor's Pick: Best Budgeting Apps ; 2. Monarch Money. best budgeting app Monarch money. Monarch ; 3. Empower. best budgeting app Empower Personal.

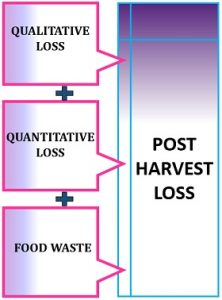

Loss Harvest

Many advisors consider the last few weeks of the year to be tax-loss harvesting season. We know it is a hallmark of their end-of-year financial planning. Tax-loss harvesting allows you to sell an investment at a loss to offset gains you've realized and reduce your overall tax burden by reducing your net capital. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Tax-Loss Harvesting is a way to make an investment portfolio work even harder – not just in generating investment returns, but by also generating tax savings. You can effectively tax loss harvest by selling investments with unrealized losses and applying those losses against previously realized gains. IBKR's Tax Loss Harvest tool helps financial advisors to potentially reduce their clients' tax liability by easily harvesting losses across multiple assets for. Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains. What is tax loss harvesting? Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains and/or regular income.¹. The U.S. federal government allows investors. Many advisors consider the last few weeks of the year to be tax-loss harvesting season. We know it is a hallmark of their end-of-year financial planning. Tax-loss harvesting allows you to sell an investment at a loss to offset gains you've realized and reduce your overall tax burden by reducing your net capital. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Tax-Loss Harvesting is a way to make an investment portfolio work even harder – not just in generating investment returns, but by also generating tax savings. You can effectively tax loss harvest by selling investments with unrealized losses and applying those losses against previously realized gains. IBKR's Tax Loss Harvest tool helps financial advisors to potentially reduce their clients' tax liability by easily harvesting losses across multiple assets for. Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains. What is tax loss harvesting? Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains and/or regular income.¹. The U.S. federal government allows investors.

Tax-lost harvesting only works in a taxable account. Doing this in a TFSA/RRSP does absolutely nothing. You can't tax-harvest losses when there's no capital. With tax loss selling in Canada, you can then use these losses to offset your taxable capital gains. Can tax loss harvesting offset dividends in Canada as well? Tax loss harvesting is when you purposefully sell assets at a loss. In turn, the losses from those investments' gains let you offset your gains elsewhere in. Tax loss harvesting is a strategy that uses investment losses to create tax savings. The idea is to purposely sell investments that have gone down in value so. This method of intentionally selling investments at a loss in order to lower taxes is known as tax-loss harvesting. Investors can use tax-loss harvesting by selling non-registered investments for a value below their original cost. What is tax loss harvesting? Tax-loss harvesting operates on the principle of converting investment losses into tax savings. Securities held in a taxable account can be sold— or “harvested”. Through a strategy known as tax-loss harvesting, once you sell, or realize, an investment loss, you can use the loss to reduce your overall taxable income or. Tax-loss harvesting isn't always the right answer. If it won't generate more than enough tax savings to offset the trading costs involved, then it's not worth. My investment losses can potentially become tax benefits through a process called tax-loss harvesting. While many investors focus on tax-loss harvesting toward. Tax-loss harvesting is the method of selling investments at a loss in order to reduce the amount of money you'll owe for income taxes. IBKR's Tax Loss Harvest tool helps financial advisors to potentially reduce their clients' tax liability by easily harvesting losses across multiple assets for. Tax-loss harvesting can help you: · Reduce your overall tax liability by offsetting gains and/or income for people subject to taxes on their capital gains. Tax-loss harvesting is an investment strategy that allows you to reduce your taxable investment income by offsetting your capital gains with losses. When you. Tax-loss harvesting is a powerful tool that may help reduce current tax liabilities for taxable accounts and potentially leave you more to invest over time. Dynamic Tax Loss Harvesting (DTLH) is a tax efficient management overlay service that seeks to harvest losses in eligible Chief Investment Office (CIO). You can effectively tax loss harvest by selling investments with unrealized losses and applying those losses against previously realized gains. One advantage of taxable accounts is that you can use losses that inevitably occur in some years to lower your tax bill. This is called tax loss harvesting. Tax-loss harvesting lets you manage your tax burden by selling securities like stocks, bonds, mutual funds, and ETFs at a loss to offset the taxes owed on.

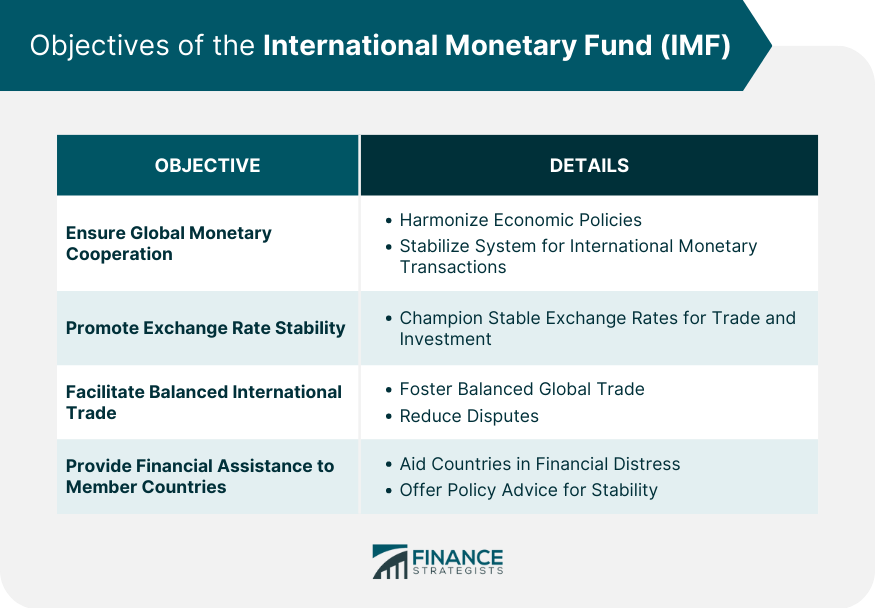

International Monetary Fund Definition

The International Monetary Fund (IMF) is an international organization that provides financial assistance and advice to member countries. International Monetary Fund (IMF), Specialized agency of the United Nations system. It was conceived at the Bretton Woods Conference (). The International Monetary Fund (IMF) is an international organization that promotes global economic growth and financial stability, encourages international. The IMF works to foster global growth and economic stability by providing policy, advice, and financing to its members. The IMF is an international agency that tries to promote trade and improve economic conditions in poorer countries, sometimes by lending them money. The key functions of the IMF are the surveillance of the international monetary system and the monitoring of members' economic and financial policies, the. The IMF is an organization of member countries that works to foster global monetary cooperation, secure financial stability, facilitate international trade. The International Monetary Fund (the IMF or the Fund) was created at the end of World War II to administer a system of fixed exchange rates. Organization established by international treaty in to promote monetary cooperation among its members. Its statutory purposes include promoting the. The International Monetary Fund (IMF) is an international organization that provides financial assistance and advice to member countries. International Monetary Fund (IMF), Specialized agency of the United Nations system. It was conceived at the Bretton Woods Conference (). The International Monetary Fund (IMF) is an international organization that promotes global economic growth and financial stability, encourages international. The IMF works to foster global growth and economic stability by providing policy, advice, and financing to its members. The IMF is an international agency that tries to promote trade and improve economic conditions in poorer countries, sometimes by lending them money. The key functions of the IMF are the surveillance of the international monetary system and the monitoring of members' economic and financial policies, the. The IMF is an organization of member countries that works to foster global monetary cooperation, secure financial stability, facilitate international trade. The International Monetary Fund (the IMF or the Fund) was created at the end of World War II to administer a system of fixed exchange rates. Organization established by international treaty in to promote monetary cooperation among its members. Its statutory purposes include promoting the.

The IMF is an organisation of over countries, promoting global monetary cooperation, financial stability, international trade, employment and sustainable. International Monetary Fund definition: an international organization that promotes the stabilization of the world's currencies and maintains a monetary. Definition. The IMF is an international organization that aims to promote global economic growth and financial stability, encourage international trade. The International Monetary Fund, both criticized and lauded for its efforts to promote financial stability, continues to find itself at the forefront of global. The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by member. The International Monetary Fund (IMF) promotes global financial stability, fosters economic cooperation, and provides financial assistance to member. Lesson Summary. The International Monetary Fund, or IMF, was legally created in as a special agency of the United Nations. The main purpose of the IMF is. The International Monetary Fund (IMF) is an organization of countries, with the stated aims of working to foster global monetary cooperation. At present, the International Monetary fund consists of member countries. The IMF is often regarded as a key organisation in the International Economic. International Monetary Fund (IMF). Browse Terms By Number or Letter: An organization founded in to oversee exchange arrangements of member countries and. The IMF's principal activities have included stabilizing currency exchange rates, financing the short-term balance-of-payments deficits of member countries. The IMF promotes global macroeconomic and financial stability and provides policy advice and capacity development support to help countries build and maintain. The International Monetary Fund (IMF) is an organization of countries, working to foster global monetary cooperation, secure financial stability. The International Monetary Fund (IMF) was established in July in Bretton Woods, New Hampshire and became operational on March 1, The International Monetary Fund (IMF) is an institution of the United Nations that sets standards for the global economy with the aim of strengthening its. The International Monetary Fund (IMF) is an international financial institution and a specialized agency of the United Nations. The International Monetary Fund (IMF) is an organization of countries, working to foster global monetary cooperation, secure financial stability, facilitate. The IMF is responsible for monitoring exchange rates and the stabilisation of the global monetary system. The International Monetary Fund (IMF) is an organization that is involved in various aspects of standard setting, implementation, and monitoring in the field. An international organization established in to enhance stability and convertibility in the international monetary system. The Fund assists any member.

Meta Trader 4 Log In

MetaTrader 4. Switch to the MetaTrader 5 mode. To switch to the MetaTrader 5 Login: Password: Save password. Server: 24prime-demo. 24prime-demo2. Authorization is connection of terminal to the server through a login and a password. It allows to manage a trading account. MetaTrader 4 is a free-of-charge Forex trading platform. It offers wide technical analysis options, flexible trading system, algorithmic and mobile trading. "To login to your trading account on PC or Mac, open MT4 or MT5. Select File from the top-left corner " Read more. If MT4 isn't working, it's most probably down to a login issue. First check whether you're getting any of the following messages: On desktop Take a look at. Login. PU Prime MetaTrader 4. MetaTrader 4, widely known as MT4, is one of the most powerful and widely-used trading platforms on the market. Download MT4. Our powerful MT4 Trading Platform App combines OANDA's pricing and execution with MT4's charting and analysis to give you the best trading experience. You can log in to your terminal from the menu at the top left of the screen. Click 'File', 'Login to trade account' and a new box asking for your login. To log in to MetaTrader 4: Click “File” -> “Log In”; Within the log in window, uncheck the box “Save Account Information”; Confirm the correct server for. MetaTrader 4. Switch to the MetaTrader 5 mode. To switch to the MetaTrader 5 Login: Password: Save password. Server: 24prime-demo. 24prime-demo2. Authorization is connection of terminal to the server through a login and a password. It allows to manage a trading account. MetaTrader 4 is a free-of-charge Forex trading platform. It offers wide technical analysis options, flexible trading system, algorithmic and mobile trading. "To login to your trading account on PC or Mac, open MT4 or MT5. Select File from the top-left corner " Read more. If MT4 isn't working, it's most probably down to a login issue. First check whether you're getting any of the following messages: On desktop Take a look at. Login. PU Prime MetaTrader 4. MetaTrader 4, widely known as MT4, is one of the most powerful and widely-used trading platforms on the market. Download MT4. Our powerful MT4 Trading Platform App combines OANDA's pricing and execution with MT4's charting and analysis to give you the best trading experience. You can log in to your terminal from the menu at the top left of the screen. Click 'File', 'Login to trade account' and a new box asking for your login. To log in to MetaTrader 4: Click “File” -> “Log In”; Within the log in window, uncheck the box “Save Account Information”; Confirm the correct server for.

RegisterSign in. MetaTrader 4 (MT4). Free to download right on our website, Exness provides traders with MetaTrader 4 trading platform for trading currency. To login, simply download Trading Station, select 'Real' Or 'Demo' on the login screen, and enter your MT4 credentials. MetaTrader 4 (MT4) classic terminal is still an unquestionable leader among retail traders Sign InOpen an account · Home; MetaTrader 4. MetaTrader 4. One of. Logging in to MT4 · Go to the File menu and select Login to Trade Account. · In the window that pops open, copy the credentials from the welcoming email you got. This video shows you how to log into your MetaTrader 4 account. Just follow these simple steps and you'll be ready to start trading! Open MT4 & enter your Equiti account details in the authorisation login box. If it hasn't popped up, you can also go to 'File' > 'Login to Trade account' and. Partners Overview Introducing Brokers Affiliate Refer A Friend Partners Login. Help. Contact Us FAQ. Fusion Markets All rights reserved. Privacy Policy. Trade Forex from your smartphone or tablet! MetaTrader 4 (MT4) is the world's most popular Forex trading platform. Choose from hundreds of brokers and. Download the Metatrader 4 (MT4), a free Forex and CFD trading platform by MetaQuotes login. Guaranteed full data backup and security - Save and backup a copy. Supercharge your trading with MetaTrader 4 (MT4). Download the powerful MT4 platform and trade CFDs & Forex with Vantage. Explore our advanced features. The MetaTrader 4 Web platform allows trading Forex from any browser and any operating system. The powerful MetaTrader 4 trading system allows you to implement strategies of any complexity. The Market and pending orders, Instant Execution and trading from. Register Login · Login · Register. The world's most popular instruments at your fingertips. Trade online wherever you are with the HFM App. Scan to Download HFM. person Sign in. help Help expand_more. info Support · email Email. menu close MetaTrader 4. Our custom-built bridge combines OANDA's pricing and. Connect to hundreds of brokers and trade on currency markets from the MetaTrader 4 for iPhone or iPad! The mobile trading platform allows you to perform. Once your account is created, we will send you the login details. Download and install MT4 platform. Installation is fully automatic and once it's completed. Download MT4 trading platform from Pepperstone. MT4 features live quotes, real-time charts, in-depth news and analytics, as well as a host of order. Download, login and trade on the world's most user-friendly trading platform. Access from desktop, web, phone, tablet and Mac. Fully Customisable. Customise. Start trading with MT4, the advanced trading platform that lets you customize and enhance your trading. Login and password you can find in the e-mail "Trading account details" for trading account and "Demo Account details" for the demo account.

Credit Card Transaction Limit

A transaction limit is an amount limit you set on your personal credit card or an Additional Cardholder's card to make sure individual transactions over the set. Based on the type of credit card you hold, your buffer limit can range between 3% and 15% of your total credit limit. Spending more than your assigned credit. i. For credit card, the maximum a Federal Agency may collect in a single transaction is $24, ii. For debit card, there is no limit. If we allow the transaction, we may require you to pay the over-limit amount along with your next statement's Minimum Payment. You will still be liable . credit card transaction. To use your PIN instead of signing, select "debit However, unlike the Truth in Lending Act protections for credit cards, which cap. Debit/ATM card limits; Credit card limits. To find your transaction limits using online banking. Choose any checking or savings account from the dashboard. A credit limit is the maximum amount a cardholder can spend using a credit card. A credit card issuer will review several factors to determine the credit limit. Select your credit card account. · Find the credit limit below your account number and available credit. It's displayed within the “Overview” section. I used an RBC Visa to pay $16, in a single transaction. Don't overthink this, it will work fine as long as you have high enough credit limit. A transaction limit is an amount limit you set on your personal credit card or an Additional Cardholder's card to make sure individual transactions over the set. Based on the type of credit card you hold, your buffer limit can range between 3% and 15% of your total credit limit. Spending more than your assigned credit. i. For credit card, the maximum a Federal Agency may collect in a single transaction is $24, ii. For debit card, there is no limit. If we allow the transaction, we may require you to pay the over-limit amount along with your next statement's Minimum Payment. You will still be liable . credit card transaction. To use your PIN instead of signing, select "debit However, unlike the Truth in Lending Act protections for credit cards, which cap. Debit/ATM card limits; Credit card limits. To find your transaction limits using online banking. Choose any checking or savings account from the dashboard. A credit limit is the maximum amount a cardholder can spend using a credit card. A credit card issuer will review several factors to determine the credit limit. Select your credit card account. · Find the credit limit below your account number and available credit. It's displayed within the “Overview” section. I used an RBC Visa to pay $16, in a single transaction. Don't overthink this, it will work fine as long as you have high enough credit limit.

Credit card spending limit factors include your income, credit utilization, and payment history.

Your credit limit is the maximum amount of money, in total, you can borrow on your credit card at any one time. This is the amount available on the Payment Card for a single purchase. A transaction includes the purchase price plus tax, freight and installation. When you make purchases outside the U.S. you may incur an additional fee each time you swipe your card. Typically, this fee is around 3% per transaction. How to. The Federal Reserve initially proposed a limit of 12 cents per transaction, but ultimately set the cap at 21 cents, plus % percent of the total purchase. No, credit cards don't have a daily limit provided by the issuer but a user can have define a daily limit in order to minimize the loss in case. This transaction limit applies to both credit card and direct debit transactions processed through a Blackbaud Merchant Services account. A floor limit—also known as a credit floor—is the maximum charge that a merchant will accept on a credit card without obtaining authorization from the card. The cash credit line is a portion of the total credit available on your credit card, and is the maximum available credit for Bank Cash Advance transactions. Maximum Credit Card Transaction Limit: $24, The U.S. Department of the Treasury has announced that effective June 1, , the maximum transaction. Generally, your limit is included on your credit card statement or is available via your online account. You can also call the number on the back of your card. Any approved transactions above your credit limit are subject to over-the-limit (or over-limit) fees. This credit card fee is typically up to $35, but it can't. card purchase, or engages in any other transaction that causes the overdraft. Interest will accrue from the date each advance is made. Your credit card must. Exceeding your credit card limit can result in a fee being added to your monthly statement. To “max out” a card means reaching your credit limit. Exceeding your. The term "standard floor limit" refers to the transaction size beyond which merchants are required to obtain authorization when processing a credit card. In general, a merchant is not permitted to establish a minimum or maximum amount for a Visa transaction. However, exceptions apply in the U.S. and U.S. So on a card that has a total credit limit of Rs 50,, if you have spent Rs. 15, already, then your available credit limit is Rs. 35, Credit limit. A transaction limit is an amount limit that you set on your personal credit card or an Additional Cardholder's card to make sure individual transactions over. The monthly limit is from the 12 th of the month through the 11 th of the next month and the transaction limit is your single purchase limit. A credit limit is the maximum amount of credit you can spend on your credit card — it's the total amount you can borrow. Your credit limit and available credit. Follow any of the below mentioned process to activate or set/modify the usage/limits for different transaction categories on your SBI Credit Card.